UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ | |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box: | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a‑12 |

UFP TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

UFP TECHNOLOGIES, INC. | |

(Name of Registrant as Specified In Its Charter) | |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

Payment of Filing Fee (Check the appropriate box): | |

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

UFP TECHNOLOGIES, INC.

100 HALE STREET

NEWBURYPORT, MASSACHUSETTS 01950‑3504 USA

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

of

UFP TECHNOLOGIES, INC.

To Be Held on June 7, 20235, 2024

The Annual Meeting of Stockholders of UFP Technologies, Inc. (“we,” “us,” “our,” or the “Company”) will be held on June 7, 2023,5, 2024, at 10:00 a.m., Eastern Daylight Time. There will be no physical meeting location. The Annual Meeting will be a virtual stockholder meeting, conducted via live audio webcast, through which you can submit questions and vote online. The Annual Meeting can be accessed by visiting http://www.virtualshareholdermeeting.com/UFPT2023UFPT2024 and entering your 16-digit control number included in your proxy materials or on your proxy card. The Annual Meeting will be for the following purposes:

1. | To elect the seven directors identified as standing for election in the accompanying proxy statement, each to serve until the |

2. | To vote on a non‑binding advisory resolution to approve the compensation of our named executive officers; |

3. | To |

|

|

| To transact such other business as may properly come before the |

The Board of Directors has fixed April 10, 202311, 2024 as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting. It is expected that this proxy statement and the accompanying proxy will be mailed to stockholders on or about May 3, 2023.2024.

You are cordially invited to attend the virtual Annual Meeting.

By Order of the Board of Directors | |

Christopher P. Litterio |

Newburyport, Massachusetts

April 25, 2023

26, 2024

YOUR VOTE IS IMPORTANT

YOU ARE URGED TO VOTE, SIGN, DATE, AND RETURN THE ACCOMPANYING ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN THE POSTAGE‑PAID ENVELOPE ENCLOSED FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, THE PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE EXERCISE BY FILING WITH THE SECRETARY OF THE COMPANY A WRITTEN REVOCATION, BY EXECUTING A PROXY WITH A LATER DATE, OR BY ATTENDING AND VOTING AT THE VIRTUAL ANNUAL MEETING.

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR OUR ANNUAL MEETING OF STOCKHOLDERS TO BE HELD VIRTUALLY ON JUNE 7, 2023:5, 2024: This Proxy Statement, our Annual Report for the fiscal year ended December 31, 20222023 and the Proxy Card are available at our website, www.ufpt.com/investors/filings.html.

UFP TECHNOLOGIES, INC.

100 HALE STREET NEWBURYPORT, MASSACHUSETTS 01950‑3504 USA

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 7, 20235, 2024

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of UFP Technologies, Inc., a Delaware corporation (“we,” “us,” “our,” or the “Company”), with its principal executive offices at 100 Hale Street, Newburyport, MA 01950‑3504, for use at the Annual Meeting of Stockholders to be held on June 7, 2023,5, 2024, and at any adjournment or postponement thereof (the “Meeting”). The enclosed proxy relating to the Meeting is solicited on behalf of our Board of Directors and the cost of such solicitation will be borne by us. It is expected that this proxy statement and the accompanying proxy will be mailed to stockholders on or about May 3, 2023.2024. Certain of our officers and employees may solicit proxies by correspondence, telephone or in person, without extra compensation. We may also pay to banks, brokers, nominees and certain other fiduciaries their reasonable expenses incurred in forwarding proxy material to the beneficial owners of securities held by them.

Only stockholders of record at the close of business on April 10, 202311, 2024 will be entitled to receive notice of, and to vote at, the Meeting. As of that date, there were outstanding and entitled to vote 7,612,9707,670,487 shares of our Common Stock, $0.01 par value (the “Common Stock”). Each such stockholder is entitled to one vote for each share of Common Stock so held and may vote such shares either in person or by proxy.

Out of an abundance of caution to support the health and well-being of our employees, stockholders, and communities, theThe Meeting will be held as a virtual meeting only, via a live audio webcast. There will be no physical meeting location. You will be able to attend the meeting online and vote your shares electronically during the meeting by visiting http://www.virtualshareholdermeeting.com/UFPT2023UFPT2024 and entering your 16-digit control number included in your proxy materials or on your proxy card. Even though the Meeting is being held virtually, stockholders will have the ability to participate in, hear others, and ask questions during the Meeting.

The meeting webcast will begin promptly at 10:00 a.m. Eastern Daylight Time on June 7, 2023.5, 2024. Online check-in will begin promptly at 9:45 a.m. Eastern Daylight Time on that date, and you should allow ample time for the online check-in procedures. We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or during the meeting, please call the technical support number that will be posted on the virtual stockholder meeting login page at http://www.virtualshareholdermeeting.com/UFPT2023.UFPT2024.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company currently has a total of seven directors, who were elected to serve until the 20232024 Annual Meeting of Stockholders and until their successors have been duly elected and qualified. Each nominee, if elected, will serve for a one-year term ending at the 20242025 Annual Meeting of Stockholders and until his or her successor has been duly elected and qualified.

Each nominee has indicated his or her willingness to serve, if elected. It is the intention of the persons named as proxies to vote for the election of the nominees. If any of the nominees declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election, the persons named as proxies will vote the proxy for such substitutes, if any, as the present Board of Directors may designate. We have no reason to believe that any of the nominees will be unable to serve if elected. The nominees have not been nominated pursuant to any arrangement or understanding with any person.

The following table sets forth certain information with respect to each of our current directors and nominees for director. When used below, positions held with us include positions held with our predecessors and subsidiaries:

Board Committees | Board Committees | ||||||||||||||||||||||||

Name | Age | Position | Director | Year Term | Audit | Compensation | Nominating | Age | Position | Director | Year Term | Audit | Compensation | Nominating | |||||||||||

R. Jeffrey Bailly | 61 | President, Chief Executive Officer and Chairman of the Board of Directors | 1995 | 2024 | 62 | Chief Executive Officer and Chairman of the Board of Directors | 1995 | 2025 | |||||||||||||||||

Thomas Oberdorf | 65 | Director | 2004 | 2024 | X | X | 66 | Director | 2004 | 2025 | X | X | |||||||||||||

Marc Kozin | 61 | Director | 2006 | 2024 | X (Chair)* | X | 62 | Director | 2006 | 2025 | X | X | |||||||||||||

Daniel C. Croteau† | 57 | Director | 2015 | 2024 | X | X (Chair) | 58 | Director | 2015 | 2025 | X | X (Chair) | |||||||||||||

Cynthia L. Feldmann | 70 | Director | 2017 | 2024 | X (Chair) | X | 71 | Director | 2017 | 2025 | X (Chair) | X | |||||||||||||

Joseph John Hassett | 65 | Director | 2022 | 2024 | X | 66 | Director | 2022 | 2025 | X (Chair) | X | ||||||||||||||

Symeria Hudson | 55 | Director | 2022 | 2024 | X | X | 56 | Director | 2022 | 2025 | X | X | |||||||||||||

† Lead Independent Director

* It is expected that Mr. Hassett will serve as the Chair of the Compensation Committee commencing July 2023.

† | Lead Independent Director |

Mr. Bailly has served as our Chairman of the Board since October 2006 and as Chief Executive Officer President, and a director since January 1, 1995. He joined the Company in 1988 and served as a Division Manager (1989‑1992)(1989-1992), General Manager Northeast Operations (1992‑1994)(1992-1994), and as our Vice President of Operations (1994‑1995)(1994-1995), and as its President (1995-2024). From 1984 through 1988, Mr. Bailly, a former certified public accountant, was employed by Coopers & Lybrand. Mr. Bailly is a member of YoungWorld Presidents’ Organization (YPO Gold).Organization. As a result of these and other professional experiences, Mr. Bailly possesses particular knowledge and experience in operations, accounting, finance, mergers and acquisitions, and executive leadership within a manufacturing environment that strengthen the Board’s collective qualifications, skills, and experience.

Mr. Oberdorf has served as one of our directors since 2004. Presently Mr. Oberdorf is Chief Executive Officer and Chairman of SIRVA, Inc. a leading global provider of moving and relocation services to corporations, consumers, and governments.governments, and has served in that role since 2017. From August 2010 through March 2011, Mr. Oberdorf consulted for Orchard Brands, a multi‑channelmulti-channel marketer of men’s and women’s apparel for the 55+ market segment. From December 2008 through August 2010, Mr. Oberdorf was Executive Vice President and Chief Financial Officer of infoGROUP, Inc., which provides business and consumer databases for sales leads and mailing lists, database marketing services, data processing services, e‑mailemail marketing, market research, and sales and marketing solutions. From June 2006 through 2008, Mr. Oberdorf was Senior Vice President, Chief Financial Officer, and Treasurer of Getty Images Inc., the world’s leading creator and distributor of still imagery, footage, and multi‑mediamultimedia products, as well as a recognized provider of other forms of premium digital content, including music. From March 2002 through June 2006, Mr. Oberdorf was Senior Vice President, Chief Financial Officer, and Treasurer of CMGI, Inc., a supply chain management, marketing distribution and ecommerce solutions company, where he served as a consultant from November 2001 through February 2002. From February 1999 through October 2001, Mr. Oberdorf was Senior Vice President and Chief Financial Officer of Bertelsmann AG’s subsidiary, BeMusic Direct, a direct‑to‑consumerdirect-to-consumer music sales company. From January 1981 through January 1999, Mr. Oberdorf served in various capacities at Readers Digest Association, Inc., most recently as Vice President Global Books & Home Entertainment—Finance. As a result of these and other professional experiences, Mr. Oberdorf possesses particular knowledge and experience in manufacturing and accounting, finance, capital markets, and public company experience that strengthen the Board’s collective qualifications, skills, and experience.

Mr. Kozin has served as a one of our directors since 2006. Mr. Kozin served as President of L.E.K. Consulting from 1997 through 2011 and as a seniorSenior Advisor from 2011 through 2018. In December 2020, Mr. Kozin joined the Board of Vascular Biogenics (Nasdaq: VBLT), a late stage oncology company, as Vice Chairman and was appointed Chairman in July 2021. In December 2022, Mr. Kozin transitioned to the Board of Healthcare Royalty PartnersHoldings from that company’s StrategicStrategy Advisory Board where he had been serving as chairperson since January 2013. Previously, Mr. Kozin served on the boards of directors of Isleworth Healthcare Acquisition Corporation, Endocyte (sold to Novartis), OvaScience, Inc (merged with Millendo Therapeutics), Dyax (sold to Shire), Dicerna (sold to Novo Nordisk), Frequency Therapeutics (merged with Korro), Flex Pharma (merged with Salarius), VBL Therapeutics (merged with Notable), OvaScience (merged with Millendo), Crunchtime! Information Systems, Medical Simulation Corporation, Brandwise, Advizex, Lynx Therapeutics, Inc., Assurance Medical, Inc., and Dicerna (sold to Novo Nordisk).Isleworth Healthcare Acquisition Corporation. As a result of these and other professional experiences, Mr. Kozin possesses particular knowledge and experience in strategic planning and the leadership consulting of complex organizations that strengthen the Board’s collective qualifications, skills, and experience.

Mr. Croteau has served as one of our directors since December 2015. Presently Mr. Croteau is a member of the Board of Directors of Corza Medical, a private equity-backed company that specializes in high performance wound closure products, biosurgical products and ophthalmic instrumentation. Mr. Croteau served as the CEO of Corza Medical from January of 2021 to January of 2023, when he retired. His prior company, Surgical Specialties Corporation, in which he served as CEO from 2017 until the Company was acquired in January 2021 and was simultaneously combined with the Tachosil Business from Takeda Pharmaceuticals to form Corza Medical. Mr. Croteau was the Chief Executive Officer of Vention Medical from January 2011 until March 2017, when he resigned in connection with the acquisition of Vention Medical by Nordson Corporation and the divestiture of the Vention Device Manufacturing Services business unit to MedPlast Inc. Vention Medical provides component manufacturing, assembly and design services for disposable medical devices, with fourteen facilities across the United States, Central America, Ireland, and Israel. Prior to assuming his role with Vention Medical, Mr. Croteau was President of FlexMedical from July 2005 through December 2010. FlexMedical is the medical division of Flex (Nasdaq: FLEX), which provides manufacturing and supply chain services for disposable medical devices, medical equipment, and drug delivery devices. From July 2004 to June 2005, Mr. Croteau served as the Executive Vice President and General Manager of Orthopedics for Accellent (renamed Lake Region Medical in 2014 and now a division of Integer), a manufacturer of specialty components and finished medical devices used in orthopedic, cardiology, and surgical devices. From August 1999 to June 2004, Mr. Croteau served as an executive at MedSource Technologies, which was merged in June 2004 with UTI Corporation to form Accellent. As Senior Vice President at MedSource Technologies, Mr. Croteau was responsible for sales, marketing, strategy and acquisitions. Prior to entering the medical device industry in 1999, Mr. Croteau spent the majority of his career in various roles at General Electric and working as a consultant for Booz & Company in Sydney, Australia. Mr. Croteau has a Bachelor of Science degree in mechanical engineering from the University of Vermont and a Master of Business Administration from Harvard Business School. Since May 2019, Mr. Croteau has served on the board of directors of Resonetics, a privately held laser manufacturing services company providing micro components to global medical device companies. From October 2014 to March 2018 and from July 2020 to present, Mr. Croteau also served as a member of the board of directors of Inventus Power, a privately held, global manufacturer of custom battery packs, chargers, and portable power supply systems. As a result of these and other professional experiences, Mr. Croteau possesses knowledge and experience in manufacturing and design, particularly in the medical device industry, that strengthenstrengthens the Board’s collective qualifications, skills, and experience.

Ms. Feldmann has served as one of our directors since June 2017. In March 2022, Ms. Feldmann joined the board of Alexandria Real Estate Equities, Inc. (NYSE: ARE), an urban office real estate investing trust focused on collaborative life science, agtech and technology campuses in AAA innovation cluster locations. She serves on the Alexandria board’s Science and Technology Committee. In September 2020, Ms. Feldmann joinedserved on the board of Frequency Therapeutics, Inc. (Nasdaq: FREQ), a clinical-stage biotechnology company focused on harnessing the body’s innate biology to repair or reverse damage caused by a broad range of degenerative diseases, andwhere she chairs Frequency’salso chaired the Frequency Audit Committee.Committee from September 2020 until November 2023 when Frequency was combined with Korro Bio(Nasdaq: KRRO) in a reverse merger. Since 2005, Ms. Feldmann has served on the board of directors of STERIS PLC (NYSE: STE), a provider of infection prevention, decontamination, and health science technologies, products and services. She chairs the STERIS Nominating & Governance Committee and previously chaired and is a current member of the Audit Committee. She also previously served as a member of the STERIS Compliance and Technology Committee. Ms. Feldmann also served from 2003 to January 1, 2018 on the board of directors of Hanger Inc. (NYSE: HNGR), a provider of orthotic and prosthetic services and products, and the largest orthotic and prosthetic managed care network in the U.S. Ms. Feldmann served on the Audit Committee, including as Chair of the Audit Committee, the Compensation Committee and the Quality and Technology Committee of Hanger. From 2013 to 2023 Ms. Feldmann currently servesserved on the board of directorstrustees and iswas a member ofand previously chaired the Finance Committee of Falmouth Academy, an academically rigorous, co-ed college preparatory day school for grades 7 to 12. Ms. Feldmann previously served as a director (andand chair of the Audit Committee and as a member of the Nominating and Governance, Compensation, and Quality and Technology Committees)Committees of Heartware International, Inc., a Nasdaq-listed medical device company, from 2012 until its acquisition by Medtronic in August 2016. Previously, Ms. Feldmann had a 29-year career in public accounting; she was Partner at KPMG LLP, holding various leadership roles in the firm’s Medical Technology and Health Care & Life Sciences industry groups and was National Partner-in-Charge of the Life Sciences practice for Coopers & Lybrand (now PricewaterhouseCoopers LLP), among other leadership positions she held during her career there. Ms. Feldmann was a founding board member of Mass Medic, a Massachusetts trade association for medical technology companies, where she also served as treasurer and as a member of the board's Executive Committee during her tenure from 1997 to 2001. Ms. Feldmann is a retired CPA. As a result of these and other professional experiences, Ms. Feldmann possesses particular knowledge and experience in accounting, finance, and capital markets, and public company experience particularly in the medical device industry, that strengthen the Board’s collective qualifications, skills and experience.

Mr. Hassett has served as one of our directors since June 2022. PresentlyCurrently Mr. Hassett is Senior Vice President and Chief Transformation Officer for Analog Devices Inc, (“ADI”), prior to his current role he was Senior Vice President and Chief Operating Officer for the Maxim Business sincefrom August 2021 through 2023 where he leadsled Analog Devices Inc.’s (“ADI”) strategic and operational focus to integrate Maxim Inc., a $2.5 billion business acquired by ADI in August 2021. Mr. Hassett brings extensive experience as a business leader having run ADI’s largest revenue-generating business, operational expertise leveraging his previous Global Operations & Technology leadership, in addition to his various engineering management roles with ADI. Previously, Mr. Hassett was Senior Vice President, Corporate Integration Management where he led significant efforts in M&A transactions and was responsible for developing strategies that drove the integration of multi-billion-dollar transactions from due diligence to fully integrated entities from December 2020 to July 2021. Previously, Mr. Hassett was Senior Vice President of Industrial and Consumer Group from November 2019 to December 2020 where he led growth initiatives which leveragethat leveraged its extensive franchise capability in measurement, sensing, and testing andtesting. He was Senior Vice President of Global Operations & Technology from May 2015 to November 2019, where he was instrumental in setting and executing our manufacturing strategy and creating a world-class, scalable supply chain to deliver outstanding quality for our customers. Mr. Hassett joined ADI in 1982 after graduating from the University of Limerick where he earned a Bachelor of Science degree in Manufacturing Engineering. Mr. Hassett also holds a Master of Business Administration from the University of Limerick. As a result of these professional experiences, Mr. Hassett possesses particular knowledge and experience in strategic and operational efforts related to merger and acquisition transactions and extensive experience as a global leader in revenue generation, operations, and engineering management that strengthens the BoardsBoard's collective qualifications, skills, and experience.

Ms. Hudson has served as one of our directors since June 2022. Presently, Ms. Hudson is the President and CEO of United Way Miami. Prior to the United Way Miami role, she served as CEO of Chapman Partnership.Partnership from 2019 to 2022. Ms. Hudson serves as an executive Board Member and on the Governance Committee for MTF Biologics, an Operating Advisor for Revival Healthcare Partners; and Ms. Hudson served as a Board Member for Baxter Foundation. From April 2016 to January 2018, Ms. Hudson was the President of Global Franchises and Innovation for ConvaTec, a $1.8 Billion international medical products and technologies company. From December 2013 to March 2016, Ms. Hudson served in various strategic leadership roles for Baxter, Inc., a $10.7 billion company that develops, manufactures, and markets products providing a broad portfolio of essential renal hospital products including home, acute and in-center dialysis; sterile IV solutions; and infusion systems and devices. Before joining Baxter, Ms. Hudson was the VP of Continuous Improvement & Transformation for Hospira, Inc (now Pfizer), a $4 billion world leader in specialty generic injectable pharmaceuticals, generic acute-care and oncology injectables, integrated infusion therapy devices and medication management solutions. From May 2005 to July 2013, Ms. Hudson served as General Manager of Medication Management Systems, VP of Global Marketing for On-Market Product Strategies Devices, VP of Marketing – US Region Medication Management Systems, and VP of Continuous Improvement and Transformation. Between August 1999 and February 2005, Ms. Hudson served in various leadership roles for Aon Corporation, an $8 billion risk management, retail, reinsurance & wholesale brokerage, claims management, specialty services, and human capital consulting services company; and Household International, an $8 billion financial service provider of consumer loans, credit cards, auto finance, and credit insurance products in the US, UK, and Canada. Ms. Hudson holds a Master of Business Administration from Harvard Business School and a BS from Alabama A&M University. She was recognized as a Top 50 Business Leader of Color in 2015. As a result of these experiences, Ms. Hudson possesses the knowledge and leadership experience, particularly in the medical products and technologies industries that strengthensstrengthen the Board’s collective qualifications, skills, and experience.

Vote Required

Directors are elected by a plurality of the votes cast by stockholders entitled to vote at the Meeting. Votes withheld and broker non‑votes will not have any effect on this proposal. Accordingly, the nominees receiving the highest number of “for” votes at the Meeting will be elected as directors. Proxies solicited by the Board will be voted “for” the nominees listed above unless a stockholder has indicated otherwise in the proxy.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE NOMINEES LISTED ABOVE AS STANDING FOR ELECTION AT THE MEETING, TO SERVE UNTIL THE ANNUAL MEETING OF OUR STOCKHOLDERS IN 2024,2025, AS DESCRIBED ABOVE.

EXECUTIVE OFFICERS

The names of our current executive officers, who are not also members of our Board of Directors, and certain biographical information furnished by them, are set forth below:

Name | Age | Title | ||

Ronald J. Lataille |

| Senior Vice President, Treasurer, and Chief Financial Officer | ||

Mitchell C. Rock |

| President | ||

Christopher P. Litterio |

| General Counsel, Secretary, and Senior Vice President of Human Resources | ||

Jason Holt | 50 | Vice President and Chief Commercial Officer | ||

Steven G. Cardin |

|

| ||

|

| Vice President and |

Mr. Lataille joined the Company in November 1997 as our Chief Financial Officer. Prior to joining us, Mr. Lataille served as Vice President, Treasurer and Chief Financial Officer of Little Switzerland, Inc., from 1991 through October 1997. He also served as interim President and Chief Executive Officer of Little Switzerland from October 1994 through October 1995. From 1984 to 1991, Mr. Lataille, a former certified public accountant, was employed by Coopers & Lybrand.

Mr. Rock initially joined the Company in 1991 and served as Director, Sales and Marketing of what was our Moulded Fibre division. From May 1999 through October 2000, Mr. Rock served as Vice President, Sales and Business Development of Esprocket, an internet start up company. Mr. Rock rejoined us in April 2001 as Vice President, Sales and Marketing of what was our Moulded Fibre division and served as our Vice President of Sales and Marketing from May 2002 to June 2014. From June 2014 to June 2021, Mr. Rock served as our Senior Vice President of Sales and Marketing, and from January 1, 2020 to June 2021, Mr. Rock also served as General Manager, Medical. SinceFrom June 2021, Mr. Rock served as President, UFP MedTech. Since February 2024, Mr. Rock has served as President UFP MedTech.of the Company. Since 2016, Mr. Rock has also served on the board of directors of Outlook Amusements, Inc., an entertainment company specializing in advice-based products and services.

Mr. Litterio joined the Company in November 2017 as General Counsel and Senior Vice President of Human Resources. From 1989 until 2017, Mr. Litterio was engaged in the private practice of law at Ruberto, Israel & Weiner, PC, a Boston-based law firm, where he focused on complex business litigation and employment law. From 2005 until 2017, he served as the firm’s managing partner, and from 2000 until 2005, he was the chair of the firm’s litigation department.

Mr. Holt joined the Company in 2018 as General Manager and in June of 2021 was appointed Vice President by the Board of Directors. Since January 2023 Mr. Holt was General Manager of Advanced Components as well as Chief Commercial Officer of MedTech. Since January 2024, Mr. Holt is Chief Commercial Officer overseeing the development and customer interfacing functions of the Company’s business. From 2004-2018, Mr. Holt held a number of leadership positions at a Fortune 200 company, Illinois Tool Works, where he ultimately became Vice President and General Manager of a $100+ million business unit.

Mr. Cardin joined the Company in 2019 as Chief Operating Officer of the MedTech business. In June of 2021, the Board of Directors promoted him to Vice President. Prior to joining the Company, Mr. Cardin spent 27 years in a variety of leadership positions in the medical device industry for OEMs and contract manufacturers. From 2017 until 2019, Mr. Cardin served as President of Viant Medical, a Tier 1 contract manufacturer of medical components and devices. Before entering the medical manufacturing field, Mr. Cardin, a graduate of the United States Military Academy, served as a Captain in the United States Army.

Mr. Holt joined the Company in 2018 as General Manager and in June of 2021 was appointed Vice President by the Board of Directors. Mr. Holt is responsible for the Advanced Components portion of the Company’s business, and, since January 2023, is also Chief Commercial Officer, MedTech. From 2004-2018, Mr. Holt held a number of leadership positions at a Fortune 200 company, Illinois Tool Works, where he ultimately became Vice President and General Manager of a $100+ million business unit.

Executive officers are chosen by and serve at the discretion of our Board of Directors.

CORPORATE GOVERNANCE

Corporate Governance Framework

Our Board of Directors has adopted a set of corporate governance guidelines and, as described in further detail below, a Code of Ethics that applies to all directors, officers and employees. The guidelines and Code of Ethics, together with the charters of the standing committees of our Board of Directors, our certificate of incorporation, and bylaws, are the framework of our corporate governance. Our governance materials are available on our website, www.ufpt.com/investors/governance.html.

Meetings of the Board of Directors

Our Board of Directors held fourfive meetings during 2022.2023. Each director attended at least 75% of the aggregate of all meetings of the Board of Directors and each committee each such director served on during 2022.2023. All our directors are encouraged to attend our Annual Meeting of Stockholders. All our directors were in attendance at our 20222023 Annual Meeting.

Independence, Diversity, Leadership Structure and Board Committees

Independence

Our Common Stock is listed on the NASDAQ Stock Market LLC, or Nasdaq, and Nasdaq’s listing standards relating to director independence apply to us. The Board of Directors has determined that the following current directors are independent under applicable Nasdaq listing standards: Messrs. Croteau, Kozin, Hassett and Oberdorf, and Mses. Feldmann and Hudson. In making its independence determination with respect to Mr. Croteau, the Board of Directors determined that Mr. Croteau’s position through January 2023 as Chief Executive Officer of one of our customers, Corza Medical (formerly Surgical Specialties Corporation), also did not impair his independence.independence, as transactions between Corza and the Company were immaterial to both entities.

Diversity

We strive to have the members of our Board of Directors possess a diverse set of skills and background so as to best provide guidance to the management team and oversight to the Company. While the Nominating Committee does not have a formal policy in this regard, the Nominating Committee views diversity broadly to include a diversity of experience, skills and viewpoint, as well as diversity of gender and race. The Nominating Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. Skills sought include financial, capital markets, manufacturing, engineering, executive leadership, sales and marketing, organizational growth, human resources and strategic planning. We believe our Board of Directors has a minimum of one director for each of these skills.

Under Nasdaq’s Board diversity rule, approved by the SEC in August 2021, companies listed on Nasdaq’s U.S. exchange are required, subject to a phase-in period and certain exceptions, to (a) publicly disclose board-level diversity statistics using a standardized matrix and (b) have, or explain why they do not have, at least two directors who are diverse, including at least one diverse director who self-identifies as female and at least one diverse director who self-identifies as an underrepresented minority or LGBTQ+. The new rule is aimed at encouraging a minimum board diversity objective for companies and provide stockholders with consistent, comparable disclosures concerning a company’s current board composition.

Under the phase-in transition rules, the Company is required to have, or provide an explanation why it does not have, (x)(1) at least one diverse director by August 6, 2023, and (y)(2) at least two diverse directors by August 6, 2026. The table below highlights certain information regarding the current composition of our Board of Directors, as well as our Board of Directors if our current director nominees are elected, as self-identified by the director or director nominee.

Current and Proposed Board Diversity Matrix

Board Size | ||||

Total Number of Directors | 7 | |||

Male | Female | Non-Binary | Did not Disclose Gender | |

Gender Identity | ||||

Directors | 5 | 2 | ||

Number of Directors who Identify in Any of the Categories Below | ||||

African American or Black | 1 | |||

Alaskan Native or Native American | ||||

Asian | ||||

Hispanic or Latinx | ||||

Native Hawaiian or Pacific Islander | ||||

White | 5 | 1 | ||

Two or More Races or Ethnicities | ||||

LGBTQ+ | ||||

Did not Disclose Demographic Background | ||||

Leadership Structure

As noted above, our Board of Directors is currently comprised of seven directors, six of whom are independent under applicable standards.

Mr. Bailly has served as Chief Executive Officer and member of the Board since January 1, 1995. He has served as Chairman of the Board since 2006.

We recognize that different board leadership structures may be appropriate for companies in different situations and believe that no one structure is suitable for all companies. We believe our current board leadership structure is optimal for us because it demonstrates to our employees, suppliers, customers, and other stakeholders that we are under strong leadership, with the positions of Chief Executive Officer and Chairman of the Board held by a single person settingthat sets the tone and havinghas the primary responsibility forof managing our operations. A single leader for both the Company and the Board of Directors eliminates the potential for confusion or duplication of efforts and provides us with clear leadership.

Because the positions of Chairman of the Board and Chief Executive Officer are held by the same person, the Board also believes it is appropriate for the independent directors to elect one independent director to serve as a Lead Independent Director. In addition to presiding at executive sessions of independent directors, the Lead Independent Director has the responsibility to: (1) coordinate with the Chairman of the Board and Chief Executive Officer in establishing the agenda and topic items for Board meetings; (2) retain independent advisors on behalf of the Board as the Board may determine is necessary or appropriate; and (3) perform such other functions as the independent directors may designate from time to time. Mr. Croteau currently serves as the Lead Independent Director, a position he has held since July 2021.

Our overall leadership structure consists of a single individual serving as Chief Executive Officer and Chairman of the Board, with independent and experienced directors making up the majority of our Board and independent oversight provided by our Lead Independent Director. We believe that this structure is beneficial to us and our stockholders.

Risk Oversight

Our Board of Directors is responsible for providing guidance and overseeing our strategic objectives and corresponding risk management process. The Board focuses on our general risk management strategy, the most significant risks facing us, and ensures that appropriate risk mitigation strategies are implemented by management. The Board is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters.

The Board of Directors has delegated to the Audit Committee oversight of certain aspects of our risk management process. Among its duties, the Audit Committee reviews with management (a) our policies with respect to risk assessment and risk management as well as our significant areas of financial risk exposure and (b) steps management has taken to monitor and control such exposure, including our system of disclosure controls and procedures and system of internal controls over financial reporting. Our Audit Committee reviews our environmental, social and governance initiatives, as well as the Company’s information security procedures. Our Compensation Committee also considers and addresses risk as it performs its committee responsibilities. Both committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise level risk.appropriate.

Our management is responsible for day‑to‑day risk management. Our Treasury, Finance, and Internal Audit functions serve as the primary monitoring and testing function for company‑wide policies and procedures and manage the day‑to‑day oversight of the risk management strategy for the ongoing business. This oversight includes identifying, evaluating, and addressing potential risks that may exist at the enterprise, strategic, financial, operational, and compliance and reporting levels.

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks we face, and our Board leadership structure supports this approach.

Code of Ethics

Pursuant to Section 406 of the Sarbanes‑Oxley Act of 2002, we have adopted a Code of Ethics for Senior Financial Officers that applies to our principal executive officer, principal financial officer, principal accounting officer, controller, and other persons performing similar functions. We also have in place a Code of Business Conduct and Ethics that is applicable to all of our directors, officers and employees. We require all of our directors, officers and employees to adhere to this code in addressing legal and ethical issues that they encounter in the course of doing their work. This code requires our directors, officers, and employees to avoid conflicts of interest, comply with all laws and regulations, conduct business in an honest and ethical manner and otherwise act with integrity. The Code of Ethics for Senior Financial Officers, as amended, is available at our website, www.ufpt.com/investors/governance.html as an attachment to our Code of Business Conduct and Ethics. We intend to satisfy the disclosure requirement under Item 5.05 of Current Report on Form 8‑K regarding an amendment to, or waiver from, a provision of this code by posting such information on our website, at the address specified above.

Environmental, Social & Governance (ESG)

The Company’s Board of Directors unanimously agreed to the establishment of a cross-functional team led by senior executives of the Company to set the sustainability agenda and prioritize Environmental, Social, & Governance (ESG) goals and efforts to where the Company can make the most impact in our communities.objectives. The Board further designated oversight responsibility for the Company’s ESG initiatives to the Audit Committee. The Company has an established ESG Committee in response to this directive, which has developed and it is working to develop and prioritizeprioritized the ESG goals and initiatives and incorporateincorporated them into the Company’s overall strategy. The Committee is comprised of executives of the Company and a supporting cross-functional team that has worked with external consultants to develop an appropriate ESG framework that identifies appropriate areas of focus and includesincluding metrics that will allow the Company to measure its progress against the ESG goals into the future. Highlights of the Company’s ESG programs, policies and initiatives can be reviewed on the website, https://www.ufpt.com/about/sustainability-esg.html.

Nominating Committee

The Board of Directors has a Nominating Committee, which met on one occasiontwo occasions in 2022,2023, and is currently composed of Messrs. Croteau, Hassett, Kozin and Oberdorf, and Mses. Feldmann and Hudson, each of whom is an independent director under applicable Nasdaq standards. Mr. Croteau serves as Chair. Director nominees are selected by the Nominating Committee. The Nominating Committee operates pursuant to a written charter (the “Nominating Committee Charter”) that was adopted by the Board of Directors and that complies with applicable Nasdaq listing standards. The Nominating Committee Charter is available at our website, www.ufpt.com/investors/governance.html. The Nominating Committee may consider candidates recommended by stockholders as well as from other sources such as other directors or officers, third party search firms or other appropriate sources. For all potential candidates, the Nominating Committee may consider all factors it deems relevant, such as a candidate’s independence, character, ability to exercise sound judgment, diversity, age, demonstrated leadership, skills, including financial literacy and experience in the context of the needs of the Board, and concern for the long‑term interests of the stockholders. The Nominating Committee does not assign any particular weight or importance to any one of these factors but rather considers them as a whole. In general, persons recommended by stockholders will be considered on the same basis as candidates from other sources. If a stockholder wishes to recommend a candidate for election as a director at the 20242025 Annual Meeting of Stockholders, it must follow the procedures described in “Stockholder Proposals and Nominations for Director” below.

Compensation Committee

The Board of Directors has a Compensation Committee, which met on fivesix occasions in 2022,2023, and is currently composed of Messrs. Kozin, Croteau and Hassett, each of whom is an independent director under applicable Nasdaq standards. Mr. KozinHassett serves as the Chair. The Compensation Committee operates pursuant to a written charter (the “Compensation Committee Charter”) that was adopted by the Board of Directors and that complies with applicable Nasdaq listing standards. The Compensation Committee Charter is available at our website, www.ufpt.com/investors/governance.html. Under the provisions of the Compensation Committee Charter, the primary functions of the Compensation Committee include determining salaries and bonuses for our executive officers, individuals to whom stock options and other equity‑based awards are granted, and the terms upon which such grants and awards are made, adopting incentive plans, overseeing risks associated with our compensation policies and practices, evaluating the performance of our executive officers, reviewing with management compensation disclosures to be included in our filings with the Securities and Exchange Commission (“SEC”), and determining director compensation, benefits and overall compensation. The Compensation Committee or the Board of Directors may delegate limited authority to the Chief Executive Officer of the Company or one or more other officers of the Company (each, a “Designated Officer”) to assist the Compensation Committee administer and operate the 2003 Incentive Plan (as amended and restated) and to grant equity-based awards to persons other than a Designated Officer or any person who is an officer (as defined in Rule 16a-1(f)) of the Exchange Act). The Compensation Committee has the sole discretion and express authority to retain and terminate any compensation consultant, including sole authority to approve the consultant’s fees and other retention terms.

For a further description of our determination of executive and director compensation, see “Executive Compensation” below.

Audit Committee

The Board of Directors has an Audit Committee, which met on seveneight occasions in 2022,2023, and is currently composed of Mses. Feldmann and Hudson and Mr. Oberdorf, each of whom meets the enhanced independence standards for audit committee members set forth in applicable SEC rules and Nasdaq listing standards. Ms. Feldmann serves as Chair. The Audit Committee operates pursuant to a written charter (the “Audit Committee Charter”) that was adopted by the Board of Directors and that complies with currently applicable SEC rules and Nasdaq listing standards. The Audit Committee Charter is available at our website, www.ufpt.com/investors/governance.html. Under the provisions of the Audit Committee Charter, the primary functions of the Audit Committee are to assist the Board of Directors with oversight of (i) the integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, (iii) the qualifications, independence, appointment, retention, compensation and performance of our registered public accounting firm and (iv) the review and assessment of our system of internal controls and procedures. The Audit Committee is also responsible for overseeing management’s maintenance of “whistle‑blowing” procedures, the review and approval of all related-party transactions and the oversight of certain other compliance matters. See “Report of the Audit Committee” below.

Report of the Audit Committee

The Audit Committee of the Board of Directors is comprised of three independent directors, each of whom meet the enhanced independence standards for audit committee members set forth in applicable SEC rules and Nasdaq listing standards. Ms. Feldmann, and Mr. Oberdorf, and Ms. Hudson served on the Audit Committee from the beginning of the fiscal year 20222023 through the date of this Proxy Statement, with Ms. Feldmann serving as Chair. Mr. Pierce served on the Audit Committee from January 1, 2022 through June 7, 2022. Ms. Hudson served on the Audit Committee from June 8, 2022 through the date of this Proxy Statement. The Board of Directors had determined that each of Ms. Feldmann and Mr. Oberdorf qualifies as an “audit committee financial expert”, as defined by applicable SEC rules.

The Audit Committee has:

• | Reviewed and discussed with management our audited financial statements as of and for the year ended December 31, 2023; |

• | Discussed with Grant Thornton, our independent registered public accounting firm, the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC; |

• |

|

Based on the review and discussions referred to above, the Audit Committee has recommended to the Board of Directors that the audited financial statements referred to above be included in our Annual Report on Form 10‑K for the year ended December 31, 20222023 for filing with the SEC.

By the Audit Committee of the Board of Directors: | |

Cynthia L. Feldmann, Chair Thomas Oberdorf Symeria Hudson |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of April 10, 2023,11, 2024, with respect to the beneficial ownership of our Common Stock by each director, each nominee for director, each named executive officer in the Summary Compensation Table under “Executive Compensation” below, all executive officers and directors as a group, and each person known by us to be the beneficial owner of 5% or more of our Common Stock. This information is based upon information received from or on behalf of the named individuals. Unless otherwise indicated, (i) each person identified possesses sole voting and investment power with respect to the shares listed and (ii) the address for each person named below is: c/o UFP Technologies, Inc., 100 Hale Street, Newburyport, Massachusetts 01950.

Name | Shares of Common Stock | Percentage of | Shares of Common Stock | Percentage of | ||

R. Jeffrey Bailly | 366,897 | 4.82% | 271,990 | 3.54% | ||

Daniel Croteau(2)(3) | 24,735 | * | 25,736 | * | ||

Mitchell C. Rock | 16,902 | * | 20,836 | * | ||

Ronald J. Lataille | 65,501 | * | 59,894 | * | ||

Thomas Oberdorf(2)(3) | 50,287 | * | 24,715 | * | ||

Marc Kozin(2)(3) | 36,327 | * | 37,328 | * | ||

Cynthia L. Feldmann(2)(3) | 16,618 | * | 13,839 | * | ||

Symeria Hudson(2)(3) | 2,293 | * | 3,294 | * | ||

Joseph John Hassett(2)(3) | 2,293 | * | 3,294 | * | ||

Christopher P. Litterio | 11,111 | * | 9,316 | * | ||

Steven G. Cardin | 2,443 | * | ||||

All executive officers and directors as a group (12 persons)(2)(3)(5) | 599,066 | 7.80% | ||||

Jason Holt | 4,535 | * | ||||

All executive officers and directors as a group (12 persons)(2)(3) | 477,484 | 6.17% | ||||

Neuberger Berman Group LLC(4) | 706,377 | 9.28% | ||||

Blackrock, Inc (4) | 1,099,140 | 14.33% | ||||

55 East 52nd Street | ||||||

Neuberger Berman Group LLC(5) | 764,366 | 9.97% | ||||

1920 Avenues of the Americas New York, NY 10104 | ||||||

Blackrock, Inc (5) | 459,978 | 6.04% | ||||

| 55 East 52nd Street New York, NY 10055 | ||||||

Renaissance Technologies LLC(6) | 379,873 | 4.99% | ||||

| 800 Third Avenue New York, NY 10022 | ||||||

Vanguard Group, Inc (6) | 533,800 | 6.96% | ||||

100 Vanguard Boulevard Malvern, PA 19355 | ||||||

_______________________

* |

|

(1) | Based upon 7,670,487 shares of Common Stock outstanding as of April 11, 2024. |

(2) Includes shares issuable pursuant to stock options currently exercisable or exercisable within 60 days after April 10, 2023, as follows: 16,632 for Daniel Croteau, 21,550 for Thomas Oberdorf, 8,670 for Marc Kozin, 12,450 for Cynthia L. Feldmann, 1,646 for Symeria Hudson and 1,646

(2) | Includes shares issuable pursuant to stock options currently exercisable or exercisable within 60 days after April 11, 2024, as follows: 17,335 for Daniel Croteau, 21,026 for Thomas Oberdorf, 9,373 for Marc Kozin, 11,097 for Cynthia L. Feldmann, 2,349 for Symeria Hudson and 2,349 for Joseph John Hassett. |

(3) Includes 647 shares issuable to each non-employee director within 60 days of April 10, 2023

(3) | Includes 703 shares issuable to each non-employee director within 60 days of April 11, 2024 pursuant to the vesting of stock unit awards. |

(4) Shares of Common Stock beneficially owned and the information in this footnote are based solely upon information contained in a Schedule 13G filed with the SEC by Neuberger Berman Group, LLC on February 10, 2023. As of December 31, 2022, Neuberger Berman Group LLC

(4) | Shares of Common Stock beneficially owned and the information in this footnote are based solely upon information contained in a Schedule 13G/A filed with the SEC by Blackrock, Inc. on January 23, 2024. As of December 31, 2023, Blackrock, Inc. had sole voting power over 1,082,758 shares, shared voting power over 0 |

(5) Shares of Common Stock beneficially owned and the information in this footnote are based solely upon information contained in a Schedule 13G filed with the SEC by Blackrock, Inc. on February 1, 2023. As of December 31, 2022, Blackrock, Inc. had sole voting power over 450,667 shares, and sole dispositive power over 459,978

(5) | Shares of Common Stock beneficially owned and the information in this footnote are based solely upon information contained in a Schedule 13G/A filed with the SEC by Neuberger Berman Group, LLC on March 8, 2024. As of December 31, 2023, Neuberger Berman Group LLC had sole voting power over 0 shares, shared voting power over 750,640 shares, sole dispositive power over 0 shares, and shared dispositive power over 764,366 shares. |

(6) Shares of Common Stock beneficially owned and the information in this footnote are based solely upon information contained in a Schedule 13G/A filed with the SEC by Renaissance Technologies LLC on February 13, 2023. As of December 31, 2022, Renaissance Technologies LLC had sole voting power over 344,773 shares, and sole dispositive power over 379,873

(6) | Shares of Common Stock beneficially owned and the information in this footnote are based solely upon information contained in a Schedule 13G filed with the SEC by Vanguard Group Inc on February 13, 2024. As of December 31, 2023, Vanguard Group Inc had sole voting power over 0 shares, shared voting power over 13,263 shares, sole dispositive power over 514,017 shares, and shared dispositive power over 19,783 shares. |

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

Compensation Discussion and Analysis

Introduction and Scope

This Compensation Discussion and Analysis (“CD&A”) is intended to provide context for the disclosures contained in this Proxy Statement with respect to our “named executive officers.” Our named executive officers are determined in accordance with SEC rules. Under such rules, our named executive officers for fiscal 20222023 were Messrs. R. Jeffrey Bailly, Ronald J. Lataille, Mitchell C. Rock, Christopher P. Litterio and Steven G. Cardin.Jason Holt. The 20222023 compensation of our named executive officers is detailed in the tables that follow this section.

Our compensation programs are determined by the Compensation Committee of the Board of Directors, which has the ongoing responsibility for establishing, implementing, and monitoring our executive compensation programs. The Compensation Committee operates in accordance with the Compensation Committee Charter that was adopted by the Board of Directors and that complies with applicable Nasdaq listing standards. The Compensation Committee Charter is available at our website, www.ufpt.com/investors/governance.html.

Executive Summary

We are a designer and custom manufacturer of comprehensive solutions for medical devices, sterile packaging, and other highly engineered custom products. We are an important link in the medical device supply chain and a valued outsource partner to many of the top medical device manufacturers in the world. Our single-use and single-patient devices and components are used in a wide range of medical devices and packaging for minimally invasive surgery, infection prevention, wound care, wearables, orthopedic soft goods, and orthopedic implants.

Our industry is fragmented across numerous competing entities. Our ability to compete effectively depends to a large extent on our ability to identify, recruit, develop and retain key management personnel. We believe this requires a competitive compensation structure as compared to other companies of a similar size in the same or similar industries.

The compensation programs for our named executive officers are designed to align compensation objectives with our business strategies and to encourage our executives to focus on creating stockholder value. While it is critical that our compensation programs allow for the recruitment and retention of highly qualified executives, it is also important that these programs are variable in nature such that performance is a key factor in realizing value. Accordingly, our programs combine competitive base salaries with annual cash incentives and long‑term equity incentives. Specifically, we structure our named executive officer compensation to include:

• Competitive base

• | Base salary; |

• Stock

• | Annual stock grant (Chief Executive Officer only); |

• |

|

• |

|

• |

|

The equity portions of the compensation programsprogram for the named executive officers provide for a fixed dollar value in equity grants that are used to determine the number of time-based and time- and performance-based restricted stock unit awards granted to each executive officer at the current market price on the date of grant. The intent of this approach is to limit the amount of compensation variability resulting solely from fluctuations in our stock price while still providing variability in compensation based upon the achievement of financial and individual objectives.

Governance Developments

The Compensation Committee and/or the Board of Directors has taken the following steps to promote good corporate governance:

• |

|

• |

|

• |

|

• Anti‑Hedging Policy—We established

• | Anti‑Hedging Policy—We maintain a policy prohibiting insider trading practices including the hedging of our stock by our employees, including our executive officers, and directors. |

• Anti-Pledging and Margin Account Policy—We established

• | Anti-Pledging and Margin Account Policy—We maintain a policy prohibiting employees from holding our securities in a margin account or pledging our securities as collateral for a loan. |

• |

|

• |

|

• Stock Ownership Guidelines—We have adopted

• | Stock Ownership Guidelines—We maintain stock ownership guidelines for the named executive officers and independent directors that are described in more detail below. |

• Clawback Policy—We have adopted a clawback policy that

• | Clawback Policy—We have adopted a clawback policy, which is described in more detail below. |

• |

|

• |

|

Philosophy and Objectives of our Compensation Programs

The primary objectives of our compensation programs are to:

• |

|

• |

|

• |

|

• |

|

• |

|

The Compensation Committee believes that the most effective compensation program is one that provides a reasonable level of fixed income through competitive base salaries, equity grants and retirement benefits as well as additional rewards for achieving performance targets. The Compensation Committee also believes that these rewards should be in the form of both cash and non‑cash and have some component subject to time‑based vesting as a retention measure. Incentive cash bonuses are included to drive executive performance by having pay at risk so that a significant portion of potential annual cash compensation is tied to profitability targets. We also include time-based and time- and performance‑based restricted stock unit awards as a significant element of prospective executive compensation, so that the value of a portion of an executive’s compensation is dependent upon both continued, long-term employment and company‑wide performance measures.

Our Decision‑Making Process

The Role of the Compensation Committee—The Compensation Committee oversees the compensation and benefitbenefits programs for the named executive officers. The Compensation Committee is comprised solely of independent directors of the Board. The Compensation Committee works closely with management to examine the effectiveness of our executive compensation program. Details of the Compensation Committee’s authority and responsibilities are specified in the Compensation Committee Charter, which is available at our website, www.ufpt.com/investors/governance.html.

The Role of Management—The Chief Executive Officer also makes recommendations to the Compensation Committee about the compensation of our other named executive officers. The Compensation Committee considers the Chief Executive Officer’s recommendations before making a final determination of the compensation programs for the named executive officers. The Chief Executive Officer and the other named executive officers may not be present during voting or deliberations on his or her compensation.

In 2022, the Compensation Committee engaged Aon, a national compensation consulting firm, to perform an updated comprehensive comparative market study of the compensation programs offered to peer company executives and directors, and to provide recommendations on the Company’s executive compensation. The Compensation Committee used this information to evaluate and adjust executive and director compensation for fiscal 2022 and plans to use this information thereafter, as well.2023. The competitive assessment done by Aon included a survey of the following 1412 companies:

• Accuray, Inc. • AngioDynamics Inc • Anika Therapeutics, Inc. • Atrion Corp • Avanos Medical, Inc. | • CryoLife, Inc. (now Artivion) • Cutera, Inc. • DMC Global, Inc. • Integer Holdings Corp • Lantheus Holdings, Inc. | •

• Orthofix Medical, Inc.

|

The Compensation Committee intends to engage a third-party national compensation consulting firm in 2024 to do an updated market study of our compensation program.

Principal Elements of the 20222023 Compensation Program

There were five principal elements of compensation for the named executive officers during fiscal 2022:2023:

• |

|

• |

|

• |

|

• |

|

• |

|

Base Salary—The base salaries established by the Compensation Committee for our named executive officers for fiscal 20222023 are set forth below.

Named Executive Officer | Annual Base | Annual Base | ||||||

R. Jeffrey Bailly | $ | 650,000 | $ | 680,000 | ||||

Ronald J. Lataille | $ | 420,000 | $ | 440,000 | ||||

Mitchell C. Rock | $ | 420,000 | $ | 440,000 | ||||

Christopher P. Litterio | $ | 338,000 | $ | 355,000 | ||||

Steven G. Cardin | $ | 310,000 | ||||||

Jason Holt | $ | 325,000 | ||||||

Base salaries (as well as incentive bonuses and equity grants ) were reviewed and approved by the Compensation Committee in light of the market competitive assessment done by Aon in 2022 and our philosophy of positioning executive compensation at or about the 50% percentile as compared to our peer group companies. Base salaries are reviewed by the Compensation Committee annually and, if appropriate, are adjusted. As detailed below under footnote 1 to the “Summary Compensation Table,” on February 14, 2023,6, 2024, the Compensation Committee approved increases to each of the above base salaries effective January 1, 2023.2024, with the exception of Mr. Rock, whose increase to base salary was effective February 6, 2024, the date of his promotion to President.

Stock Grant— In accordance with the terms of hisR. Jeffrey Bailly’s (the Company’s Chief Executive Officer) employment agreement, wethe Company annually grantgrants to Mr. Bailly, our Chief Executive Officer,him an award of Common Stock as a component of his overall compensation. The objective of this equity component is to greater align the Chief Executive Officer’s interests with those of our stockholders. The stock is typically issued to the Chief Executive Officer in the last two weeks of the fiscal year, assuming we continue to employ the Chief Executive Officer is employed on that date. In 2022,2023, consistent with the terms of his employment agreement, the Chief Executive Officer was granted shares valued at $400,000. See “Employment“R. Jeffrey Bailly Employment Contract” below.

Cash Incentive Bonus—In the beginning of 2022,2023, following approval by the Board of Directors of our strategic plan and budget, the Compensation Committee established, at its discretion, performance targets for the named executive officers’ cash incentive bonus. This performance‑based cash bonus was based on the achievement of a combination of financial and individual objectives. Targeted payout levels were expressed as a percentage of base salary and established for each participant. An individual’s bonus components were determined by such individual’s title and/or role. Typically, the financial performance portion of the bonus fluctuates down and up based upon athe degree by which our actual results fall short of or exceed the financial objective.

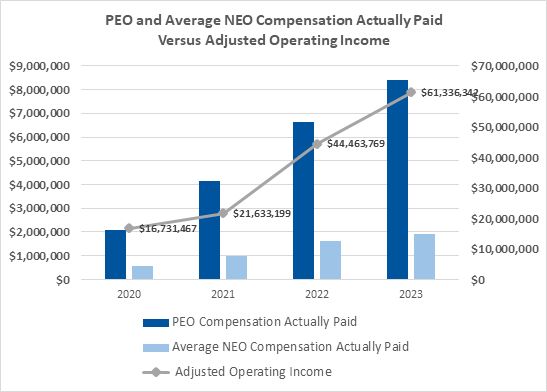

For 2022,2023, the financial objectives, which were established by the Compensation Committee at its meeting on February 15, 2022,14, 2023, were based upon targeted Adjusted Operating Income of $32,821,000.$48,227,000. Adjusted Operating Income is operating income as adjusted to disregard (i) non‑recurring restructuring charges related to plant closings and consolidations and (ii) the impact of acquired or disposed of operations during the fiscal year ended December 31, 2022.2023. Actual Adjusted Operating Income was $45,863,786$61,336,342 for fiscal year ended December 31, 2022.2023.

Individual bonus objectives for the named executive officers, other than Mr. Bailly, were designed to reward the achievement of goals related to, among other things, the following: regulatory compliance, achievement of MedTech financialgrowth goals, acquisition execution, employee development, plans, safety, quality, and quality systemscustomer service and compliance, return on invested capital successful start-up in Mexico and investor relations. Individual bonus objectives for Mr. Bailly were designed to reward the achievement of goals related to acquisitions, reduced manufacturing costs, safety and quality compliance and return on invested capital.

For 2022,2023, the following cash incentive bonuses were awarded by the Compensation Committee based upon our financial performance as well as the targeted payout levels and individual performance measures for each named executive officer:

R. Jeffrey Bailly—Mr. Bailly’s targeted payout level was 90%100% of base salary, or $585,000,$680,000, with $339,300$400,000 tied to our financial performance and $245,700$280,000 tied to individual goals. The financial component of the incentive bonus for Mr. Bailly fluctuates by 10% of the amount by which the actual Adjusted Operating Income exceeds the targeted Adjusted Operating Income, with a maximum financial componentIncome. Mr. Bailly’s total incentive bonus of $700,000.is capped at 2 times his base salary, or $1,360,000. To the extent that actual Adjusted Operating Income is less than 80% of targeted Adjusted Operating Income, the financial component of Mr. Bailly’s incentive bonus is zero. To the extent that actual Adjusted Operating Income equals or exceeds 80% of targeted Adjusted Operating Income but is less than targeted Adjusted Operating Income, the financial component of Mr. Bailly’s incentive bonus is determined as $169,650$200,000 (half of the targeted bonus) plus 2.58%2.07% of the amount by which actual Adjusted Operating Income exceeds 80% of targeted Adjusted Operating Income. Based upon our financial performance as well as an assessment of his performance for fiscal 2022,2023, Mr. Bailly was awarded a total performance-based bonus amount of $944,800. In addition, based upon the Company’s extraordinary performance in 2022, Mr. Bailly was awarded a discretionary bonus of $300,000, as well as Stock Options with a value of $300,000.$1,360,000.

Ronald J. Lataille—Mr. Lataille’s targeted payout level was 45%50% of base salary, or $189,000.$220,000. Based upon our financial performance as well as an assessment of his performance for fiscal 2022,2023, Mr. Lataille was awarded a total bonus amount of $381,542.$376,417.

Mitchell C. Rock—Mr. Rock’s targeted payout level was 45%50% of base salary, or $189,000.$220,000. Based upon our financial performance as well as an assessment of his performance for fiscal 2022,2023, Mr. Rock was awarded a total bonus amount of $384,042.$370,417.

Christopher P. Litterio—Mr. Litterio’s targeted payout level was 40%45% of base salary, or $135,200.$159,750. Based upon our financial performance as well as an assessment of his performance for fiscal 2022,2023, Mr. Litterio was awarded a total bonus amount of $247,321.$253,000.

Steven G. CardinJason Holt— Mr. Cardin’sHolts’s targeted payout level was 35%40% of base salary, or $108,500.$130,000. Based upon our financial performance as well as an assessment of his performance for fiscal 2022,2023, Mr. CardinHolt was awarded a total bonus amount of $173,064, of which $108,500 was paid in cash and $64,564 was paid in the Company’s common stock.$189,127.

Long‑term Incentives—it is our philosophy and that of the Compensation Committee to provide executives with long‑term incentives and, thus,in order to align their financial interests with those of our stockholders. We maintain a stock unit award program for the named executive officers under the 2003 Incentive Plan, as amended and restated (the “2003 Incentive Plan”). On March 14, 2023, the Compensation Committee of the Company’s approved certain amendments to the 2003 Incentive Plan. The amendments, among other things, increased the aggregate maximum of Cash Performance Awards (as defined in the 2003 Incentive Plan) from $1,000,000 to $2,000,000 that may be paid to any individual pursuant to the 2003 Incentive Plan. The stock unit awards represent a right to receive shares of our Common Stock in varying amounts based on our achievement of certain financial performance objectives and time‑based vesting requirements. For 2022,2023, the following stock unit awards were approved by our Compensation Committee for grant to our named executive officers:

Threshold(1)(2) | Target Adjusted | Exceptional Adjusted | ||||||||||||||||||||||

Number of | Grant Date | Number of | Grant Date | Number of | Grant Date | |||||||||||||||||||

R. Jeffrey Bailly | 7,075 | $ | 526,733 | 7,075 | $ | 526,733 | 7,075 | $ | 526,734 | |||||||||||||||

Ronald J. Lataille | 3,158 | $ | 235,150 | 1,579 | $ | 117,575 | 1,579 | $ | 117,575 | |||||||||||||||

Mitchell C. Rock | 3,158 | $ | 235,150 | 1,579 | $ | 117,575 | 1,579 | $ | 117,575 | |||||||||||||||

Christopher P. Litterio | 1,478 | $ | 110,000 | 739 | $ | 55,000 | 739 | $ | 55,000 | |||||||||||||||

Steven G. Cardin | 1,007 | $ | 75,000 | 504 | $ | 37,500 | 504 | $ | 37,500 | |||||||||||||||

Threshold(1)(2) | Target Adjusted | Exceptional Adjusted | ||||||||||||||||||||||

Number of | Grant Date | Number of | Grant Date | Number of | Grant Date | |||||||||||||||||||

R. Jeffrey Bailly | 7,056 | $ | 787,000 | 7,056 | $ | 787,000 | 7,056 | $ | 787,000 | |||||||||||||||

Ronald J. Lataille | 2,761 | $ | 308,000 | 1,381 | $ | 154,000 | 1,380 | $ | 154,000 | |||||||||||||||

Mitchell C. Rock | 2,761 | $ | 308,000 | 1,381 | $ | 154,000 | 1,380 | $ | 154,000 | |||||||||||||||

Christopher P. Litterio | 1,224 | $ | 136,500 | 612 | $ | 68,250 | 612 | $ | 68,250 | |||||||||||||||

Jason Holt | 807 | $ | 90,000 | 404 | $ | 45,000 | 403 | $ | 45,000 | |||||||||||||||

_____________________

(1) | The “Threshold” stock unit awards are subject to time vesting only. The “Target” and “Exceptional” stock unit awards are also subject to financial performance objectives, established by the Compensation Committee as the achievement of 100% and 115%, respectively, of our targeted Adjusted Operating Income for |

(2) | One‑third of these awards vested on March 1, |

Other Practices, Policies & Guidelines

Stock Ownership Guidelines—we have adopted stock ownership guidelines for the named executive officers and independent directors. Under our stock ownership guidelines the Board has established a goal that (i) within five years after joining the Board, each non‑employee director beneficially own shares of our stock valued at three times his or her annual base cash retainer fee, (ii) within five years after being appointed to his or her position, the Chief Executive Officer beneficially own shares of our stock valued at three times his or her base salary, and (iii) within five years after being appointed to his or her position, the other named executive officers beneficially shares of our stock valued at one times his or her base salary.

Claw-back Policy for the Recovery of Erroneously Awarded Compensation— in accordance with the applicable rules of the Nasdaq Stock Market, Section 10D and Rule 10D-1 of the Securities Exchange Act of 1934, as amended, we have adopted a policy that if we are requiredPolicy for the Recovery of Erroneously Awarded Compensation to prepare an accounting restatement due to our material noncompliance, as a resultprovide for the recovery of misconduct, with any financial reporting requirement under the securities laws, within the meaning of Section 304 of the Sarbanes‑Oxley Act of 2002, our Chieferroneously awarded incentive-based compensation from Executive Officer and Chief Financial Officer shall reimburse us for any incentive bonus, or other incentive award or any equity award or profit earned from the sale of our securities, during the twelve‑month period in which the financial statements applied.Officers.

Employee, Officer and Director Hedging—our personnel are prohibited from engaging in any of the following activities with respect to our securities: (a) hedging or other similar arrangements with respect to our securities, including, without limitation, (i) short sales and (ii) buying or selling puts or calls (excluding options we have granted); and (b) holding our securities in a margin account or pledging our securities as collateral for a loan.

Deferred Compensation Plan—in 2006, we implemented the UFP Technologies Executive Nonqualified Excess Plan (the “Deferred Compensation Plan”). Under the Deferred Compensation Plan, named executive officers and other key employees are eligible to defer up to 90% of base salary and 100% of bonus and/or commissions into the plan. Investments of the deferrals are directed by the participants (notionally) and returns on the deferrals are determined accordingly. Employer contributions into the Deferred Compensation Plan are discretionary and determined by the Compensation Committee. No employer contributions were made in 2022.2023.

Supplemental Disability Insurance—named executive officers receive long‑term disability insurance coverage to supplement our group long‑term disability plan. The objective is to provide named executive officers with sufficient coverage to replace a significant portion of their wages in the event of disability. We pay the premiums, which amounted to approximately $42,460$62,196 in the aggregate for all named executive officers in 2022.2023.

Profit Sharing/401(k) Plan—all employees of UFP Technologies, Inc., including named executive officers, who meet certain criteria are eligible to participate in the UFP Technologies, Inc. 401(k) Plan (the “401(k) Plan”). For 2022,2023, the Company matched employee deferrals at(including those of our named executive officers) using a discretionary rate,safe harbor matching formula, which was 100% of the first 3%, then 50% of employee deferrals up to a maximum ofthe next 2% of an employee’s eligible wages in 2022.employee compensation deferred on each paycheck.

Perquisites—we provide welfare benefits to our named executive officers with officer contributions consistent with contributions to other UFP employees. The Chief Executive Officer is also eligible for additional perquisites including club and marina fees, life insurance and company-paid tax preparation fees. These Chief Executive Officer perquisites are offered principally to facilitate the Chief Executive Officer’s role as our representative within the community, and to entertain customers.

Policy on Equity‑Based Award Timing and Pricing

Our Board of Directors adopted a policy whereby equity‑based awards are only to be granted by the approval of a majority vote of members of the Compensation Committee at a committee meeting. Our 2003 Incentive Plan establishes fair market value as the closing price on the date of grant of any equity security, including stock options, granted pursuant to such plan.

Stockholder Advisory Vote on Executive Compensation

In reviewing our 20222023 compensation decisions and policies, we considered the results of our stockholders’ advisory vote to approve executive compensation, which was conducted at our 20222023 annual meeting of stockholders. In the proxy statement provided to stockholders in connection with our 20222023 annual meeting, our Board of Directors recommended that stockholders vote in favor of this proposal. The affirmative vote of a majority of the votes cast by the stockholders entitled to vote on this proposal at the 20222023 annual meeting was required for advisory approval of this proposal. Over 91%90% of such shares were voted to approve, on an advisory basis, our executive compensation. We considered this vote as supportive of our compensation decisions and policies.

Compensation Committee Interlocks and Insider Participation

From January 1, 2022 through June 7, 2022, the Compensation Committee was comprised of Lucia Luce Quinn, Marc Kozin and Daniel C. Croteau. From June 8, 20222023 through December 31, 2022,2023, the Compensation Committee was comprised of Marc Kozin, Daniel C. Croteau and Joseph John Hassett. None of the members of the Compensation Committee werewas an employee or a current or former officer of the Company during such period. None of the Compensation Committee members had a relationship with the Company requiring disclosure during their service on the Compensation Committee.

Report of the Compensation Committee Report

The Compensation Committee of the Board of Directors of the Company has reviewed and discussed the foregoing Compensation Discussion and Analysis with management of the Company and based on such review and discussion, the Compensation Committee has recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

By the Compensation Committee of the Board of Directors: Joseph John Hassett, Chair Marc Kozin Daniel C. Croteau | |

|

EXECUTIVE COMPENSATION

The following tables present information regarding compensation of each of the named executive officers for services rendered in fiscal years 2023, 2022 2021 and 2020.2021. A description of our compensation policies and practices as well as a description of the components of compensation payable to our named executive officers is included above.

SUMMARY COMPENSATION TABLE

| Name and Principal Position | Year | Salary($)(1) | Discretionary Bonus(2) | Stock Awards($)(3) | Non Equity Incentive Plan Compensation ($)(4) | All Other Compensation ($)(5) | Total | ||||||||||||||||||